Cardify Africa is a Nigerian startup that lets you exchange, spend and save money across several digital wallets while leveraging Naira (NGN) - The platform allows you save digital assets and fiat currency in your digital wallets, Pay bills and buy vouchers with crypto, as well as swap your fund into virtual cards for both local and international spending.

The Cardify web application is straightforward and user-friendly at first appearance, but how does this translate to its effectiveness and flawless performance promises? Let's explore.

Getting started with Cardify Africa

I'll start with the onboarding procedure.

Signing up to use Cardify

Setting up your Cardify account begins with registering on the website www.cardify.co or through any of its other .africa, .ng or .com.ng tld extensions, users can also install from the iOs appstore or the google playstore.

Your full name, password, email address, phone number and pin are credentials to create a cardify africa account. Although some of the system offerings have been developed in such a way that you could use them without registering a user account, users are still advised to register in a bid to enjoy the services offered by the platform with no restrictions.

Speaking about restrictions, Cardify offers a limit and level system to make sure its users fulfil its three-tiered level kyc system. Level 1 verification starts and ends with the user’s email and phone number verification, Level 2 is all about BVN verification: this is making sure that the user’s identity is consistent with his or her registered mobile number (Nb: Cardify does not have access to a user’s bvn detail, so it’s safe to use), Level 3 involves verifying your user credentials with your regulatory ID card and providing other details about yourself. However, Level 1 verification give users the ability to perform almost all the offerings on the Cardify Africa system.

As an important note, your Cardify username also serves as your Cardify tag, the tag is used to make internal transfers within the Cardify ecosystem, which means I can send value to any other user on the same platform with the user’s Cardify tag (More on Cardify tags in the system’s explanation).

Also worthy of note is that your email address and phone number receive an OTP for verification for level 1. Once that’s clear, you would be prompted to create a pin, the purpose of this pin is to confirm both inbound and outbound transactions on the Cardify system.

Cardify Major Systems/ Products

Exchange System, Bills System and Virtual Cards system are some of the major product offerings on Cardify. These products can be used independently of each other.However, these products all revolve around Cardify wallet system. Let me explain.

So with a Cardify account, you have access to the NGN wallet, USD wallet and GBP wallet by default, the method of funding these wallets varies as well as withdrawal methods for each of them. The wallet system is central to all other products, this means that as much as other products can be used independently, they can also be used with your Cardify wallets. An example is the Bills system, when checking out a bill purchase or order, the system gives you the option of either paying with any of your wallet balances or checking out anonymously (without logging in). The same goes for the exchange system, which allows direct off-ramp conversion of digital assets. Now let me explain each of the systems in more depth.

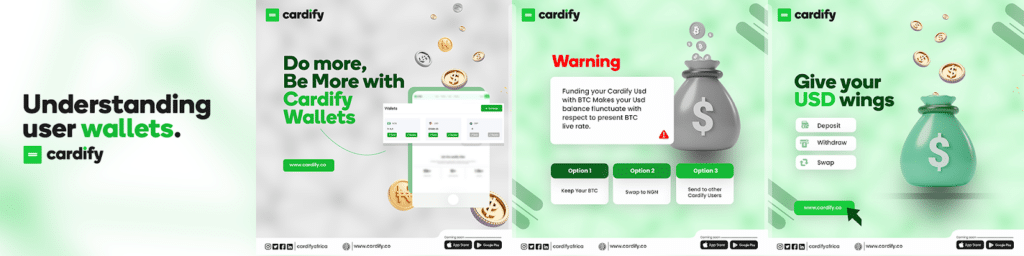

Cardify Africa Wallet System

Cardify Africa offers every user the NGN, USD and GBP wallets, the NGN wallet can be funded with Peerstack by Cardify: A peer-to-peer system by Cardify to facilitate funding of Naira accounts on the Cardify system. Withdrawals from the Naira wallet can also be made with Peerstack by Cardify. Now, funding your Naira account allows you the possibility of saving your Naira in your Cardify Naira wallet or Swapping it into any other Cardify Wallet (USD and GBP).

The Usd wallet can be funded with various options, one of those options is through the use of Stablecoins, a user is prompted to generate a unique wallet, through which the user copies a unique wallet address or scans a Qr code, so long the user sends the correct cryptocurrency to the wallet address, the Cardify system automatically recognizes the incoming payment and funds the user’s Cardify wallet balance with the value sent after confirmation (Note: I noticed that funds deposited through volatile cryptocurrencies remain volatile with respect to the present live rate, funds deposited through USDT stablecoin also remained stable in my Cardify Wallet). Other ways of funding your USD wallet include using your USD debit card as well as other methods to be released subsequently.

You also have the ability to withdraw your USD balance at any point in time to external cryptocurrency wallets as well as swap it to any of your other Cardify wallets.

Now to the GBP wallet, this works just like the NGN and USD wallet on Cardify, users are able to fund their GBP wallet directly from their UK account and then proceed to swap their GBP balance to Naira.

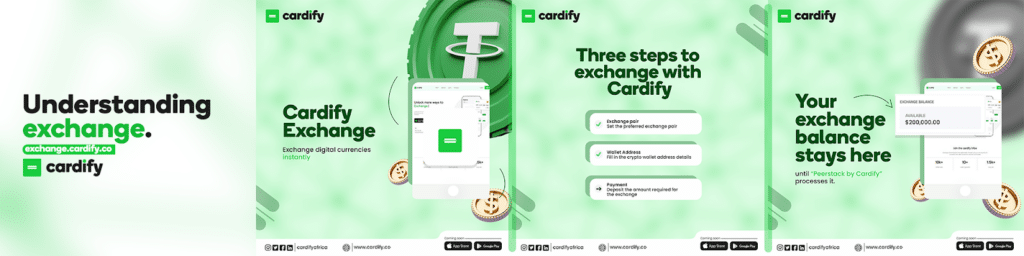

Cardify Africa Exchange System

The Cardify Africa Exchange system works similarly to the swap functionality on the wallet system. The exchange system is a principal desk OTC that lets users directly exchange digital currencies to naira, usdt to naira and other cryptocurrencies to naira leveraging a peer-to-peer transactional model.

Contrary to the wallet system swap offering, the exchange system is in direct exchange terms as the desk collects the digital assets and fulfils the transaction by remitting the equivalent (as quoted by the system) to the user’s submitted detail.

However, a great feature of the Cardify Africa Exchange is the fact that you can exchange directly from the system’s homepage without registering an account or logging in, although, there are transaction limits to what you can transact with this method due to KYC reasons, Cardify exchange offers you a simple straightforward approach at exchanging.

Cardify Africa Bills System

Cardify Africa Bills allow Nigerians and Africans, in general, to pay everyday utility bills with crypto. Users can buy airtime, mobile data, pay electricity bills and even shop from e-commerce stores like Jumia with crypto through Cardify. Accessing the bills platform from bills.cardify.co presents a list of several bills you can add to your cart, you can also checkout as a user as well as a non-user, the fascinating thing about this system is the flow, users can opt to make payment for their carted item(s) with their cardify wallet or pay directly for the item(s) in their Cardify Cart with crypto.

Cardify Africa Cards System

Cardify allows you to create flexible virtual dollar cards for local and international spending, so here’s the catch, you can fund Cardify’s virtual cards from your Cardify wallet, you still don’t get the catch? Since cardify wallet allows you to fund with your favorite cryptocurrencies, this means you can fund your cardify virtual card with Crypto and get to spend on local and international stores.

You can easily generate, freeze, unfreeze, and terminate Virtual Dollar Cards that you can use to shop and pay for subscriptions on your preferred websites with a simple to manage dashboard for the card system.

Customization options

You can make changes to your Cardify account through the ‘account’ icon. From here, you can change your name and user name, and fill in next of kin details,

You can also add your bank accounts and mobile money accounts here. I love that you get to choose between the two options.

Cardify Points

Cardify Africa allows you to earn Cardify points for referring another user with your Cardify referral link which could be found in the profile menu. The system also allows you to earn points as you transact, so that means it's a win-win every time with Cardify

Security and Support

How does Cardify handle customer care and security?

- Support as a Major Cardify Service

Have you ever tried to reach customer care only to be kept on hold for an unreasonable amount of time? I loved that Cardify went a different route by allowing you to live chat with customer care right on the website.

I got a response within 2 minutes (I actually checked) of sending the message which was quite impressive. You can also access the FAQs section from within the app.

Final thoughts

With the Cardify Africa mobile app launch set for March 4, 2023. We can expect the same features of its web application on the mobile applications, the app will focus on simplicity, being the most important leverage of the Cardify Africa ecosystem. Users will be able to perform even more tailored tasks on the Cardify app as soon as it hits the app stores.