Running a business in Nigeria comes with its own set of challenges. Every organisation must keep accurate sales, inventory, and company expenses records to ensure they have the correct information to make critical decisions.

Tracking company expenses is particularly important as poor expense management is one of the leading causes of business mortality.

But unfortunately, business owners use their current bank accounts to track their company expenses, which has proven to be very ineffective in tracking company spending.

The subsequent paragraphs will highlight some disadvantages of using a bank account to track your company spending and why you should use a Spend management platform like Flex.

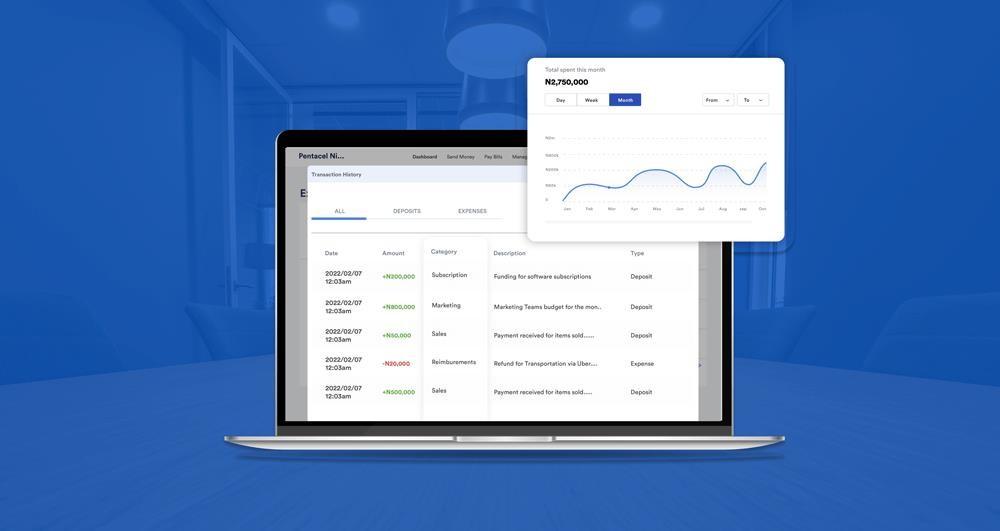

Lack of budgeting tools

Business current accounts don't provide customers with the tools they need to budget. One of the critical disadvantages is that businesses cannot see the budget performance in real-time to make intelligent spending decisions.

No expense categorisation

Business current accounts make it difficult to categorise your transaction in the appropriate expense category making reconciliation and tracking extremely difficult. Without proper transaction categorisation, detecting waste and implementing cost-saving measures would be tough. You're only given a bank statement at the end of the month that lists all your transactions with no proper expense categorisation and breakdown

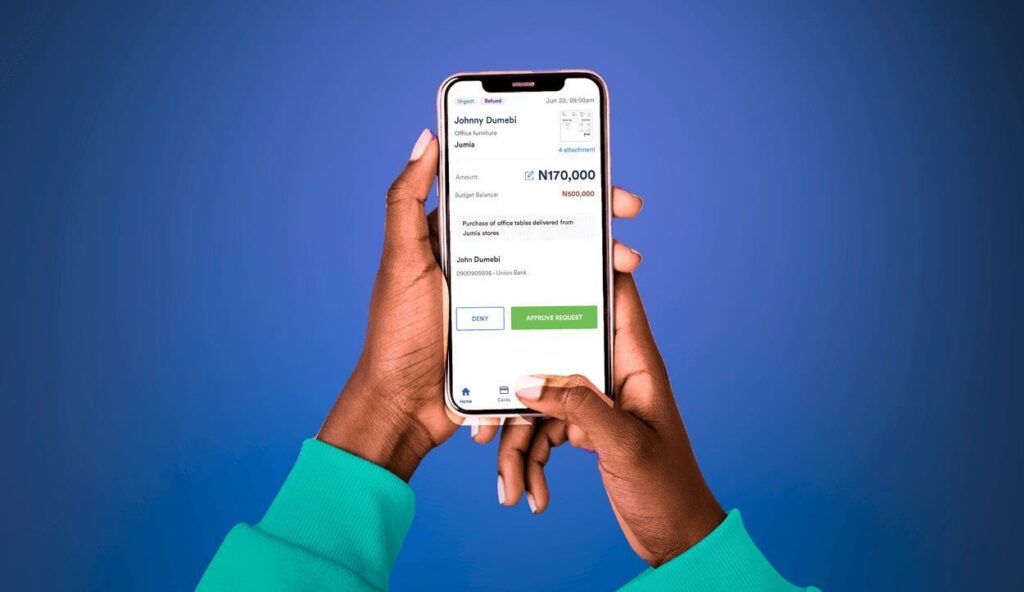

No Approval flow

Imagine if you could set up an approval process right in your business bank account for all your expense requests, where all required personnel can approve or deny expense requests before your organisation disburses. Unfortunately, current accounts don't offer this feature.

Difficulty accessing business loans

Businesses tend to find it difficult to access credit from financial institutions, one of the primary reasons being poor bookkeeping. Using a spend management platform automates your bookkeeping and ensures your books are kept automatically, making it much easier to access credit.

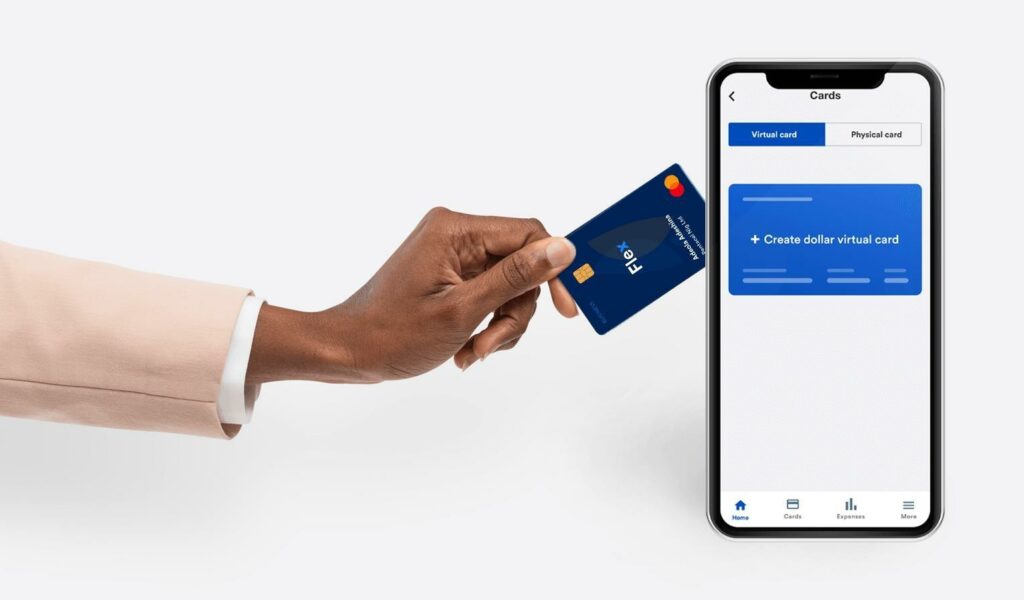

Sharing one card across your organisation

Sharing one card among team members is such a horrible way to manage card payments not only is it insecure it's challenging to track who spent from the cards or pre-approve spending. Current bank accounts do not allow you to create and assign them to each function or employee.

Use a spend management platform to manage your company's spending.

We've established why tracking your spending with a business current account isn't a great idea and why current accounts aren't equipped with the right tools to manage your spending. Your business needs a comprehensive spend management solution. A solution that empowers you to automate your budgeting & expense categorisation, digitize your approval workflow, and automate your bookkeeping to access credit.

Conclusion

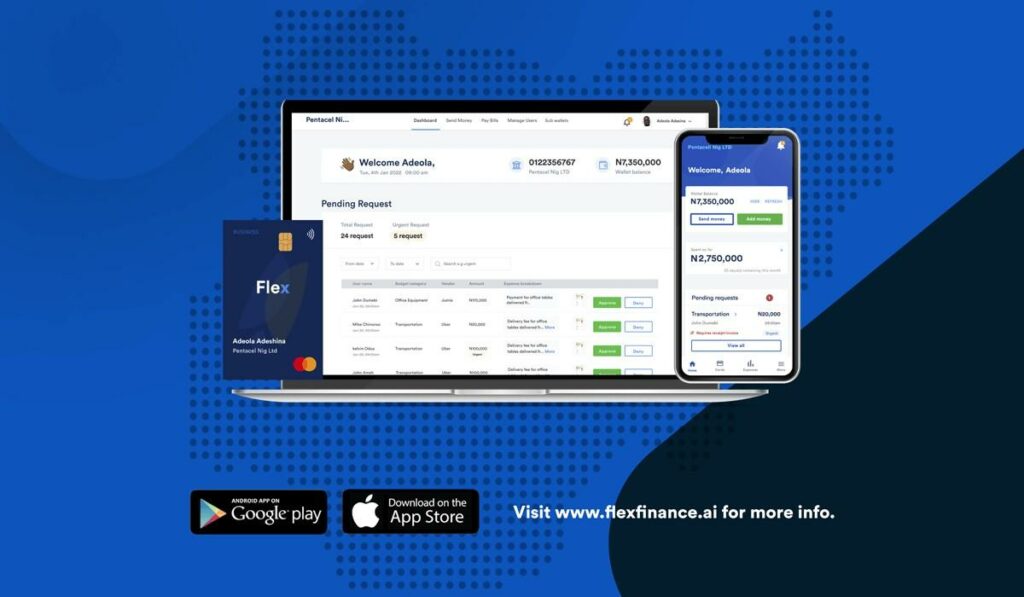

Flex Finance is the leading Spend management solution for businesses in Nigeria and Africa that empowers them to effectively track all their business spending.

Flex empowers businesses to take control of their spending, helping you save time and money. Visit www.flexfinance.ai to get started now