CapiFlex, a Nigerian payment technology company and a subsidiary of CapitalSage Technology Limited has launched its instant payment platform called CapiCollect in Kenya. The product is launched in partnership with Arronax Systems, a financial technology company based in Kenya and just after 8 months of its debut in the Nigeria market with transaction volume of over 20 billion naira securely processed.

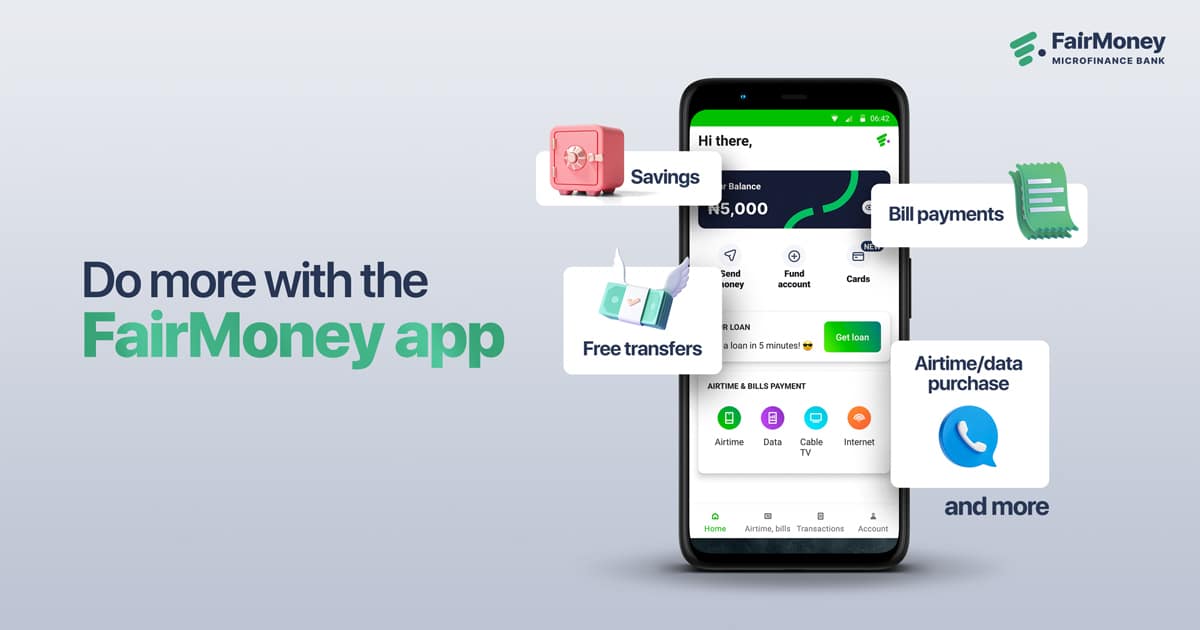

The Kenyan CapiCollect payment variant is armed with an escrow feature that not only allows businesses to receive payment securely but also allows them to build customer trust. Once the escrow is activated, payments are held in trust and are only released once the customer receives goods or services based on the agreed terms.

Speaking on the launch, Manager CapiFlex Payments, Ibukun Eko said this expansion is in line with the company’s goal to provide a flexible payments solution that eliminates wait time, loss of funds, and fraud for vendors and businesses across Africa.

“Our goal is to empower businesses in Africa with flexible payment options. In less than a year, we have on boarded over 1,000 merchants who are receiving payments securely via our platforms. The escrow agreement we introduced with our product in Kenya allows us to hold payments in trust until customers receive the goods and services they have affirmed and desired. By acting as a third party, escrow will improve the relationship between businesses and their customers by eliminating the infamous issue of "what I ordered vs. what I got" and the associated dissatisfaction.

Continuing on the Nairobi launch, Ibukun added, "At a time when businesses are seeking access to technological tools, it is important for us to stand out, particularly since we aim to be a leader in wealth creation in Africa. We see tremendous growth in the technology space in Kenya and are honoured to leverage it."

The Head of Product, CapiCollect, Olaronke Adegbite, further explained that "We started out to build a system that supports businesses of any size or scale and now we want to do more for them. We want to help them build trust and credibility. You earn your customers' trust when they know that you protect their interests, and that is exactly what we want to help them achieve. Businesses thrive on trust, and we are excited to be doing something with regard to that.”

"Additionally, we are a people’s company. At the heart of all we do, we put people first. What’s a better way to serve people in ways that truly count if not through expansion?” Olaronke Submitted.

Since launched CapiFlex has processed over 20 billion volume of transaction for over 10,000 merchants and businesses in Nigeria.