Ethereum’s price is nearing its long-term downward trend line and traders can expect ETH to bounce off this line and slump downwards toward its short-term support levels. Meanwhile, HUH Token has consolidated back to its support level, presenting an opportunity for buyers to get in before a 30% Upswing.

Ethereum (ETH)

The second largest cryptocurrency in the world has seen a mini rally this week as global markets recovered from the December 4 flash crash. Bitcoin (BTC) and Solana (SOL) have also seen a recent recovery. ETH jumped over 12% in 24 hours.

However, Ethereum is now nearing its downward trend line that has been in place since November 30 and looks set to slump back down towards its short-term support level of $3642.38.

ETH bulls will be looking to use this support level as a platform to push ETH above its current downtrend line and initiate a price reversal. If this downward trend line is broken then ETH could jump over 40% to retest its all-time high.

However, ETH’s chart does not seem to indicate that a price reversal is on the cards. Looking at the long-term picture on a daily chart indicates that ETH is likely to break below its current short-term support level and fall towards its long-term upward trend line:

Investors can expect ETH to fall near its long-term upward trend line around $3200 before offering a fresh buy opportunity for a major upswing. ETH’s relative strength index (seen at the bottom of the daily chart) has fallen while the price has gone up. This indicates a buy divergence and is further evidence that a consolidation period down to the long-term uptrend line is the most likely outcome.

On the other hand, if ETH can break above its short-term downward trend line, then the price would be expected to rally and sentiment would turn to the bullish side. If ETH breaks up the $4250 resistance level then the short-term bearish prediction will be nullified.

HUH Token (HUH)

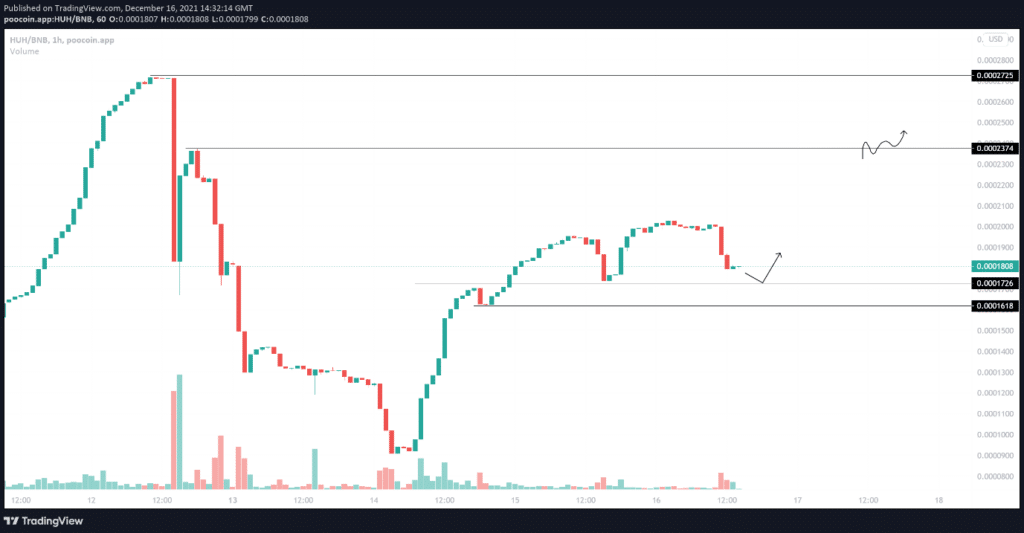

HUH Token has consolidated back to its support level at $0.0001726 presenting an opportunity for side-lined buyers to get in before a potential 30% Upswing to $0.0002374.

Earlier this week HUH Token reclaimed a support level at $0.0001726 indicating bullish appetite is strong at current levels.

Investors can now expect HUH’s price to bounce off the support level offering buyers a fresh opportunity to get in before the price swings up to test the first resistance level at $0.0002374. If HUH manages to break this barrier then the price could swing upwards to retest its all-time high at $0.0002725 - a rally of roughly 50% from current levels.

If HUH’s price can break above the all-time high at $0.0002725 then investors can expect the price to continue to move upwards and create new highs, with the first Fibonacci extension level of 23.6% or $0.0003368 as the next target.

However, if HUH’s price falls below the support level at $0.0001726, then investors can anticipate a dip to retest the next support level at $0.0001618. Potentially offering traders a new buy opportunity.

HUH Token launched December 6 and rocketed over 4000%, breaking into PancakeSwap’s top 20 in the first week of trading.

HUH has a market cap of over $160 million, with over 12 000 holders. HUH’s recent listing on popular indexes CoinMarketCap.com and CoinGecko.com has also helped push the price upwards.

For more on HUH Token:

- HUH Pay - https://huh.social/presale/index.html

- Website - www.huh.social

- CoinMarketCap https://coinmarketcap.com/currencies/huh/

- Telegram: https://t.me/HUHTOKEN

- Twitter: https://twitter.com/HuhToken

- Instagram: https://www.instagram.com/huhToken/