In the past few years, a new form of digital lending has taken the world by storm and has found significant acceptance by both merchants and consumers alike. Popularly referred to as buy now, pay later in the consumer credit space, it serves as a payment option that encourages consumers to make more purchases whether online or offline and pay over time.

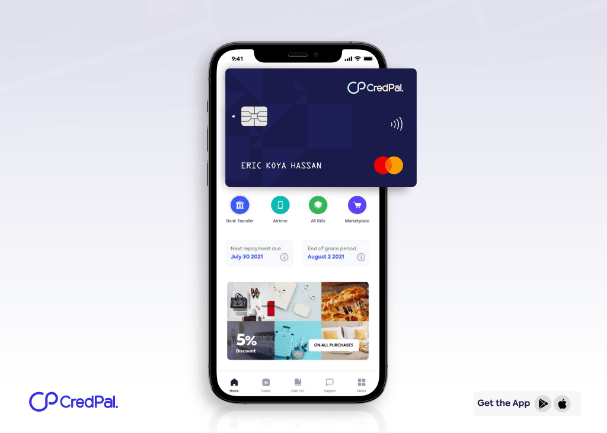

The fintech company leading the charge in Nigeria is CredPal. The company came into the market in 2018, pioneering the buy now, pay later space, which allows customers to buy more, and split payments into monthly instalments. Unlike the traditional style, buy now, pay later allows consumers get instant access to their purchase while they pay it off in months. What makes CredPal even more interesting is it’s innovative approach of offering its customers credit cards. Hence, combining the convenience of a credit card and the flexibility of buy now, pay later. This implies that customers can choose to pay up within 30days or split paymens for up to 6 months.

As the CEO and co-founder, Fehintolu Olaogun explains it, “a professional who earns 250,000 Naira can get a credit card with a limit that they can pay back at the end of their billing cycle or use it to buy now and pay later.

With CredPal’s buy now, pay later, the company enables customers to shop, enjoy discounts and cashback offers from over 13,000 merchants, and pay later. The COO and co-founder Olorunfemi Jegede said that the service is particularly differentiated in its merchant partnerships that cuts across industries ranging from hospitality, electronics and gadgets, furniture, travel and transport, real estate, grocery, beauty, and cosmetics to education.

The company has built several partnership cohorts that boasts of merchants such as Shoprite, Slot, Hard Rock Cafe, Pointek, Orile Restaurant and Bar, Mykonos on the Roof, Koffee Hut, and thousands of others. Consumers can shop, eat, lounge, travel, and pay later – the list is exhaustive.

“What we have done is encapsulate the lifestyle of the average working-class Nigerian and ensure that every person who signs up on CredPal finds something specifically for them.” said Fehintolu. Ultimately, CredPal has taken the financial needs and shopping experience of the consumer to a new level.

Through the partnership with these merchants, CredPal continues to jointly work with them to offer customers better payment options, retail innovation, and events that bring merchants closer to their customers. CredPal is not slowing down with these partnerships with over 13,000 merchants and gunning to partner with even more merchants.

The company has created an easy registration process for merchants who want to accept CredPal Pay. If you’re an interested merchant, you can register here. As Olorunfemi said, “the goal is to ensure that every shop that any Nigerian walks into, they’ll find CredPal as a payment option to buy and pay later.”

To learn more about CredPal, visit here or send an inquiry to hello@credpal.com.