2020 has seen the emergence of new kids on the Nigerian fintech block: API fintech startups. After raising impressive pre-seed rounds, Okra, Mono, and the likes look like they’re on a seemingly surefire path to success.

But before going further, here's the concept of APIs. An application programming interface (API) is a computer interface that defines interactions between multiple software intermediaries.

According to Wikipedia, these interactions include the kinds of calls or requests that can be made, how to make them, the data formats that should be used, and the conventions to follow.

They are seen as the broker between two parties. How? By accepting messages from the sender, passing them as requests to the receiver, and returning data to the sender. Similarly, via API calls, users can request information from the broker at any time.

In 2015, Paystack, a Nigerian fintech startup, came into the tech scene to address the challenges of online payment transactions.

With its API, merchants in the country can accept payments via credit card, debit card, and direct bank transfer.

In general, payment APIs receive information from customers before helping them make a payment, refund a sale, look up details of a transaction, and set up a billing plan among other things.

The importance of API fintech platforms

When the gaps in the US' underlying financial infrastructure became apparent, payment APIs like Stripe launched to fill them.

Stripe's launch in 2010 was followed by Visa-acquired fintech startup, Plaid. Launched in 2013, Plaid uses fintech APIs to connect applications with users’ bank accounts.

Don't miss out on Africa's financial revolution

Give it a try, you can unsubscribe anytime. Privacy Policy.

Join over 3,000 founders and investors

Give it a try, you can unsubscribe anytime. Privacy Policy.

Although it took longer in Nigeria, we notice a similar trend as API fintech startups like Okra launched in 2019, and Mono this year.

As Ope Adeoye, the 'chief hustler' of Onepipe.io, a fintech startup that builds and maintains APIs that enable banks to partner with modern digital services, puts it, "as is usually the case with such trends, several expressions of the same thing will then show up in other markets, now Nigeria."

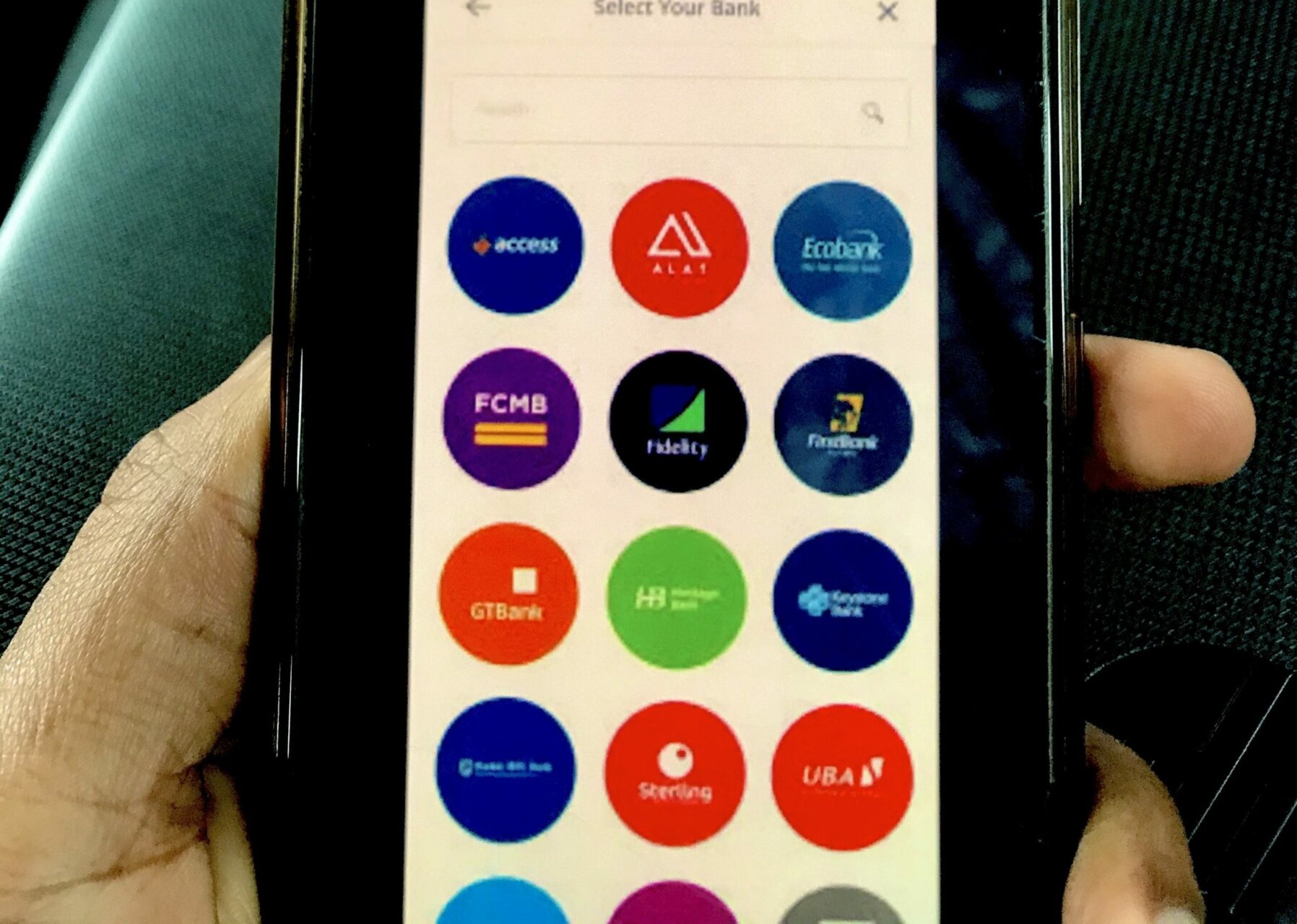

With almost the same premise of connecting individual bank accounts directly to third party applications, both startups arrived with a bang.

"If you look at it, payments has been figured out. The next step is how can we enable other companies with data. That's why you see companies like Okra and Mono coming up. Eventually, what we want to do is enable new types of companies that can use financial data to build new solutions," Abdulhamid Hassan, Co-founder and CEO of Mono says to Techpoint Africa.

If you've ever tried to give a company access to your bank statements, you might have noticed how tasking it was. A summary of the process would go like this: open the bank app, log in, download bank statement in PDF format, send to a third-party company, and await feedback.

This is what these startups are trying to solve for the average consumer. Via a permission-based system, they enable third-party companies and developers to access financial accounts of consumers for transactions, balances, bank statements, and credit, among other features.

While there are various third-party companies like real estate and accounting firms that need this service, Adeoye believes lending companies need it the most.

According to him, this is due to the infrastructural gaps in their space, and the emergence of API fintech startups makes it possible for them to de-risk and sell more loans.

"API banking enables lenders to make decisions in a more efficient manner," Hassan adds.

Also, these platforms help banks take advantage of the data they sit on, create a synergy with third-party companies, and present an opportunity for them to build new products.

Investors don't want to miss out

In January, US payments giant, Visa acquired Plaid for $5.3 billion. When a company like Visa makes that sort of acquisition, it seems like a bet on the future of finance.

Investors began to take notice of similar API fintech startups around the world.

TLCom, a Kenyan-based VC firm with offices in Lagos and London, made its presence known four months later. For a firm that rarely gives cheques to early-stage companies and fintech companies, it coughed out $1 million for Okra.

This was the company's pre-seed investment and it came in June 2020, four months after the startup officially launched.

In August 2020, Mono came onto the scene. Barely two months old, it raised $500k in pre-seed investment. This time, a number of investors like Lateral Capital, Ventures Platform, Golden Palm Investments, Rally Cap, Idris Bello, and Olumide Soyombo got in on the act.

Adeoye thinks Visa's acquisition of Plaid has put investors on the lookout as they don't want to miss out on the next best thing since Plaid.

"When something takes off, it takes off. I think that's what has happened here. Also, you will find that there's a general FOMO thing among investors. Therefore any investor that missed startup A (for whatever reason), quickly tries to back startup B before it goes away."

Technology and open banking influence

With dozens of Nigerian financial institutions on their platforms, it is easy to see why investors are bullish.

The startups charge for every session where clients connect with customers' bank accounts. Mono, for instance, uses a pay-as-you-use pricing model where clients are charged $0.05 (₦19) per API call.

Communication between API fintechs and banks is the value proposition of open banking. In an ideal situation, open banking provides banks and fintechs with customer insight and financial innovation via an API ecosystem.

According to Adedeji Olowe, a trustee at Open Banking Nigeria, the organisation is working with the Central Bank of Nigeria (CBN), fintechs, banks, and international bodies to launch an open API framework in Nigeria and Africa.

"The API standard draft is already done with contributions from over 9 banks, top fintechs and international partners. However, beyond an API standard, the other critical part of an API world is the regulation for which we are working closely with the Central Bank of Nigeria to bring to life. The CBN has pencilled open banking as part of their critical objectives for PSV 2030." he says.

While this is yet to be implemented, Hassan believes that API fintech startups have taken the initiative to pioneer open API services. For him, open banking in Nigeria is still a long shot compared to places like the UK where banks are making strides to accomplish it.

"Here, banks have not taken the opportunity to make this happen so for us, we're thinking of how we can enable these things without waiting for the banks," he says.

However, while commending the ingenuity of API fintech startups, Olowe doesn't think they are going about their technology the right way.

"First and foremost, screen scraping is not open APIs and also straddles a regulatory grey area. In the long run, the only sustainable approach is via an industry-backed open API framework."

Screen scraping is the programmatic use of a site to impersonate a web browser to extract data or perform actions that they would usually perform manually on the website.

A lethargic process nevertheless, screen scraping has been used to fetch customers' data from banks whenever clients request them.

But after raising sizeable amounts in funding, one would expect API fintechs technology to be different. Right now, they claim to have much better tech than screen scraping designed to improve customers' experiences.

That being said, Hassan remains adamant that API fintechs are going to usher in the process of Open Banking in Nigeria.

"For Mono, we have connections with the banks, third-party companies and businesses. So, we think what we're doing is building the infrastructure that would eventually enable Open Banking in Nigeria." https://zp-pdl.com/get-a-next-business-day-payday-loan.php http://www.otc-certified-store.com/hypertension-medicine-usa.html https://zp-pdl.com/get-quick-online-payday-loan-now.php http://www.otc-certified-store.com/antidepressants-medicine-europe.html https://zp-pdl.com получить займ на кивизайм 20000 на картуmoneyman займ