Last week, Jason Njoku, Co-founder and CEO of internet and entertainment company, IROKO, announced via his blog that his company will halt its African growth efforts. Also, the company will lay off 150 people.

In what has been a rough couple of months for the nine-year-old company, this comes after Njoku also announced in May this year that 28% of IROKO's staff would be going on unpaid leave.

Coming into 2020, the company had plans to increase its average revenue per user (ARPU) in Africa from $7-8 to $20-25. Through the first four months, it seemed that was in motion even as the pandemic hit the shores of the continent.

Nigeria began its lockdown procedures and measures at the start of April and that kicked a series of events that has led IROKO to make this decision.

Consumer discretionary spend reduces due to pandemic fears

The first couple of days in April saw IROKO's numbers in the country rise, hitting its highest daily increase. But this didn't last long.

The green segments in the image represent IROKO’s Nigeria market. The image shows that subscriber numbers began to reduce around April 5 and fluctuated for a while before recording similar dips on April 12, 19, and 26.

This happened because the average consumer perception of Nigeria's general economic situation and household income plunged.

And as a result, consumers began making sharp cuts in discretionary spending and while this survey by McKinsey & Company about consumer sentiment during the pandemic says Nigerians will increase spending on entertainment alongside essentials and fuel, for some, IROKO didn't qualify.

"Consumer confidence started ebbing, then completely collapsed. We spoke to thousands of our customers to understand what was happening. People were fearful, people were losing jobs. Entertainment is important, food is essential," Njoku wrote.

Join over 3,000 founders and investors

Give it a try, you can unsubscribe anytime. Privacy Policy.

According to him, IROKO subscribers in the country dropped 70%. But at the same time, international subscribers kept increasing and grew 200% during the lockdown, hitting a range of $25-30 ARPU.

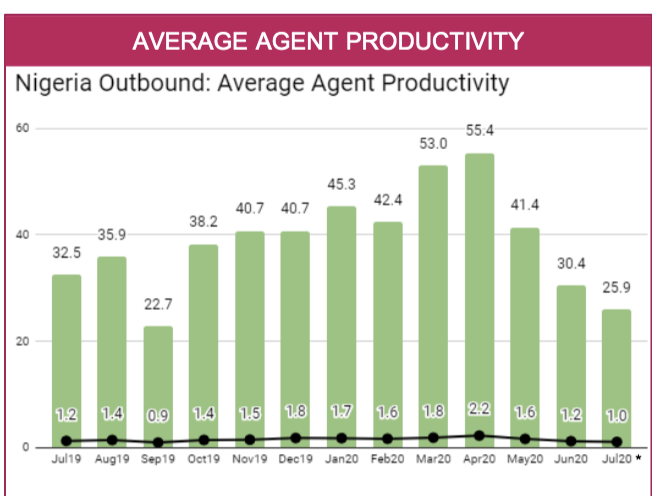

Outbound staff productivity plunges

Productivity scores from July 2019 to July 2020 show that the outbound marketing team was operating at all-time highs in March and April, with an average team productivity score of 53.0 and 55.4, respectively.

However, due to the aforementioned reduction in consumer's discretionary spending, IROKO had to furlough 47 outbound staff the lockdown made redundant.

This affected the team's score that month, dipping to 41.4. It plunged further to 30.4 and 25.9 in June and July, making the latter one of the department's worst months in the past year.

After the furlough, 150 outbound staff remained. But with this new development, it seems they'll be the set of staff to be released from the company as IROKO seeks to discontinue its growth plans in the country.

Devaluation of the naira

Months after raising $8 million from Tiger Global in 2013, IROKO decided to tweak its revenue model. The company introduced a $2.50 monthly subscription plan for its users but quickly switched it up in 2015 by launching a ₦3,000($6.3) annual subscription.

The exchange rate of the naira to the dollar stood at ₦166/$1 at the time and it seemed like a good deal for the company and users. However, massive devaluation of the naira has occurred since then and despite that, the company has stuck with the same price.

"We went through the brutal 2016 and 2017 devaluations and ended up ₦3,000 to $8.33 (₦360/$). Today ₦3,000 is $6.3 (₦477/$). All indications are that the Naira devaluation hasn’t really finished as some are saying it’s just starting and will end up at ₦550-600/$ before year’s end."

One could question the business sense in that seeing as platforms like MultiChoice's DStv increased their subscription fees over the years to accommodate devaluation and taxes. But from the look of things, this was a price IROKO was willing to pay to remain the market's leader in accessing top Nollywood content.

Regulatory onslaughts

In the past five years, IROKO has grown 83% and has become one of the most dominant consumer media companies in sub-Saharan Africa.

Emphasising on growth every year, the company's goal was to come out the victor in the SVOD wars and it looked certain IROKO would be king. But the Nigerian government had other ideas as the company was caught in one of the government's recent regulatory onslaughts on businesses.

In June, Nigeria's National Broadcasting Commission (NBC) released the amended 6th of its broadcast code. In a bid to "encourage" competition in the Nigerian movie industry, the agency mandates that pay-TV and streaming platforms should sub-license their content to other broadcasters in the country.

Coupled with the effects of the pandemic-induced lockdown on staff and consumers, and the naira's devaluation, it seems this was the last straw for the founder. Njoku says that the company will halt its growth efforts in Africa in the next 18 months and instead focus on acquiring more customers in North America and Western Europe where it is seeing significant growth that represents 80% of the company's revenue.

The founder also claims the business has lost over $30 million since launching and is currently spending $300k every month on growth efforts. But with this move, the company has a chance to save more than $250,000 monthly, thus leading to free cash flow (FCF).

Meanwhile, Njoku says IROKO plans to introduce a couple of new products outside entertainment that will help the company's ARPU in the continent even.

"We still believe in Africa. It’s a strange thing to realise that even after almost 9 years with iROKOtv, we still may be too early for Africa. That in itself says so much about the current Internet opportunity in Africa. For now, we can only focus on cash flow. We will be waiting patiently, keenly, for the key signals to jump right back to growth mode.” https://zp-pdl.com/online-payday-loans-cash-advances.php www.otc-certified-store.com www.zp-pdl.com https://zp-pdl.com займ без анкетыбыстрый займ на карту круглосуточнооптима займ