Nigeria's President Muhammadu Buhari has approved the transfer of the National Identity Management Commission (NIMC) to the Federal Ministry of Communications and the Digital Economy.

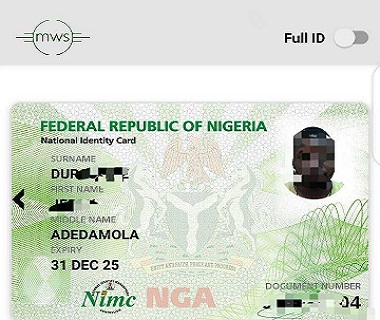

NIMC is the commission established by the NIMC Act of 2007 to provide a centralised digital database for all Nigerian citizens. Under the purview of the Office of the Secretary to the Government of the Federation, it disbursed the National Identification Number and the National Identity card under the purview of the Office of the Secretary to the Government of the federation.

The commission which is in charge of managing national identity database for Nigerians was hitherto domiciled under the Office of the Secretary to the Government of the Federation.

The Nigerian government says that this move has been put in place to ensure that there is effective ministry supervision to coordinate, monitor and track the progress of the government's mission for digital transformation.

As we explained earlier, millions of Nigerians are still without an official identity, and efforts to provide this, which dates back to the establishment of NIMC in 2007, has been challenging.

Since registration commenced in 2012, over 150 million Nigerians are yet to be registered, and data from different organisations are yet to be harmonised.

Some of these are:

- Nigerian Communications Commission (NCC): Mobile SIM registration

- Central Bank of Nigeria (CBN): Bank Verification Number (BVN)

- Independent National Electoral Commission (INEC): Permanent voter’s card

- National Population Commission (NPopC): Birth and death certificates

- Federal Road Safety Corps (FRSC): Driver’s license

The NCC, for instance, has data of over 191 million registered sim users, and about 43 million people have a BVN which is a unique identifier for Nigerian bank accounts.

The Nigerian government is making a strategic move in order to foster the cooperation and harmonisation of data between NIMC, NCC, the Nigerian Information Technology Development Agency (NITDA) and Galaxy backbone.

Be the smartest in the room

Give it a try, you can unsubscribe anytime. Privacy Policy.

Recall that in June 2019, the President appointed a steering committee to drive the integration of data from across the various government bodies mentioned above.

In the same year, the World Bank, Agence Française de Développement (AFD) and the European Union (EU), provided the West African nation with $433 million to aid the provision of identity cards for the next five years.

Registered people have found it difficult to secure identity cards and a few weeks ago, the NIMC experimented with an app that allowed people to download their cards online, but later advised people to avoid using it for now.

The commission's transfer to the ministry of communications and the digital economy seems to be a vote of confidence in the Minister's achievement since he assumed office a little over a year ago.

A number of infrastructure needs to be in place to ensure the success of this initiative and it remains to be seen how things will play out in the coming weeks. zp-pdl.com http://www.otc-certified-store.com/anti-inflammatories-medicine-europe.html https://zp-pdl.com/get-quick-online-payday-loan-now.php https://zp-pdl.com/online-payday-loans-cash-advances.php займ на карту сбербанка без отказасмс займоформить займ