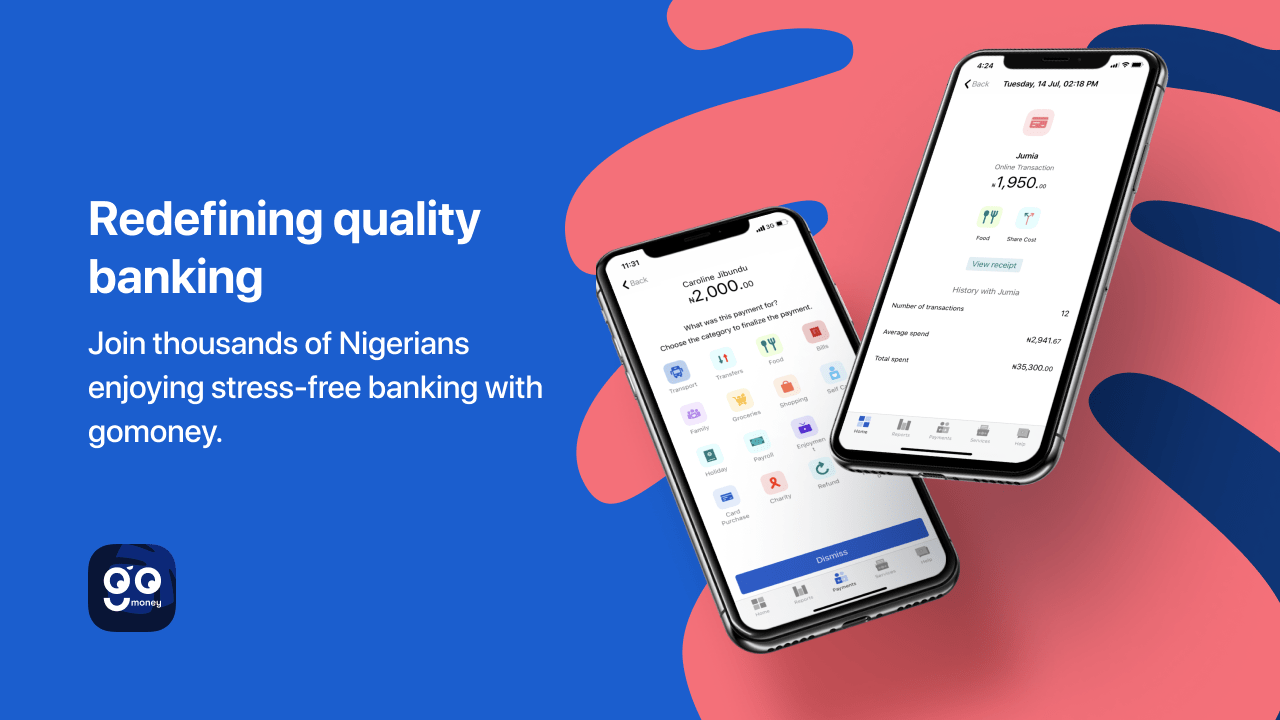

The banking platform on our "must have" list right now is gomoney. It's the holy trinity: beautiful, efficient and user-friendly.

From what we've seen, easy access — you can download the gomoney app, open an account on your phone and start making transactions in under 3 minutes, low transfer cost (N8.50) and no hidden charges. Their blog confirms that you only get charged for three things: a quarterly card maintenance fee and sending money to other banks.

When you open a gomoney account, you are automatically placed under a default tier that you can then upgrade for free, depending entirely on your spending needs. According to their website, this is both for security and to efficiently accommodate the needs of every Nigerian, regardless of their income bracket.

So, what is gomoney?

So, what is gomoney?

gomoney is a digital-only bank with a lot of exciting features that are not available with traditional bank apps. You can send and receive money, effortlessly, but beyond that, the app helps you:

Cruise through transaction processes

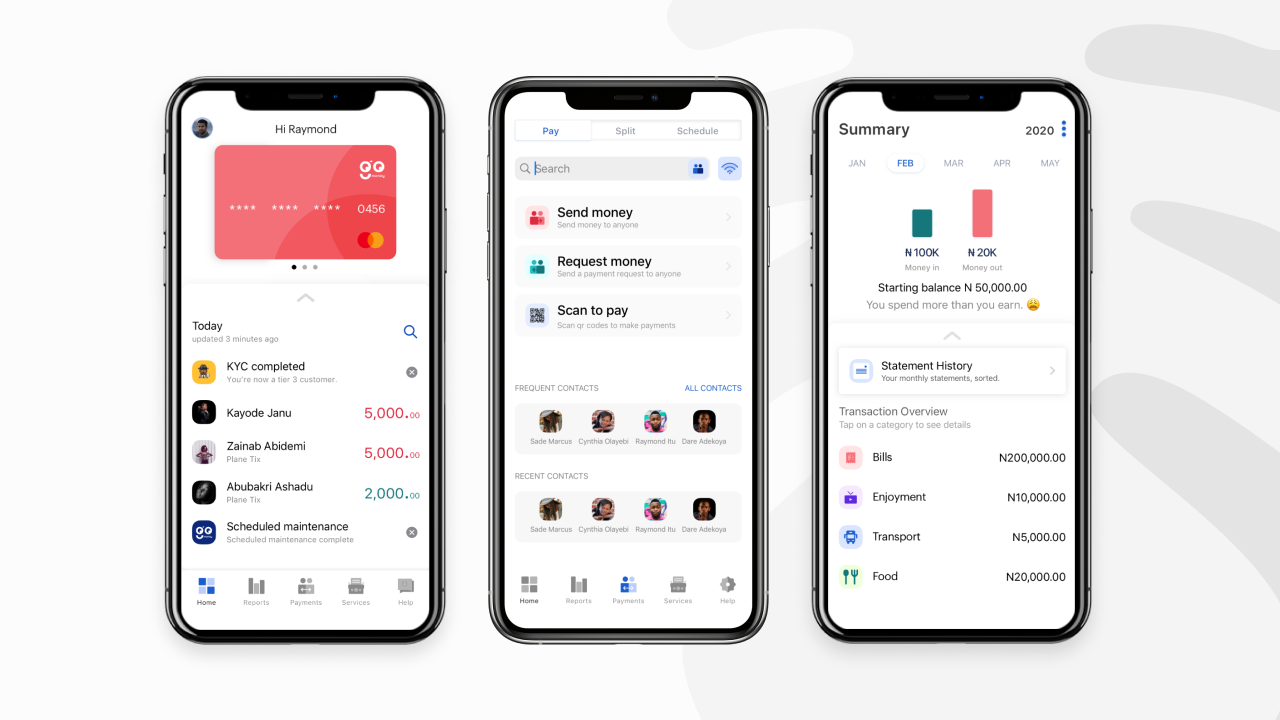

gomoney prioritises your convenience here. You can send and receive money through payment links or bank transfer. The app also allows you to setup one-time or recurring payments in advance.

While there aren't gomoney physical cards yet, you can generate a free virtual card on the app and start making online payments within 24 hours. They've created a platform that allows you to finally get the best out of your money at almost no cost.

Manage and understand your spending

Manage and understand your spending

gomoney emphasises the desire to help users understand their spending habits so that they can make better financial decisions. They have accomplished this with a Reports feature dedicated to showing you what you spent, how you spent it and where. This report is currently split into 16 different spending categories so that you can take everything in at a glance.

Also, there's an in-built Split Bill feature that allows you create split group for your shared expenses with anybody and send them reminders as you please! It's truly the bank you deserve.

There are plenty of resources to help you get started on the gomoney blog and website! So check it out, download the app and join the gomoney army