The US stock market is the biggest stock market in the world, accounting for over 50% of global stock market value. The combined market capitalization of the NYSE (New York Stock Exchange) and NASDAQ is currently about $40.2 trillion. For comparison, the Nigerian stock market has a total market cap of $38.3 billion.

It doesn’t matter what you’re investing in. Be it stocks, bonds, real estate, or any other financial instrument, the goal of investing is simple: generate extra income.

Arguably, stocks have shown to offer the most potential for growth as compared to many other asset classes. They are also far more liquid and diversifiable than real estate and many other fixed-income assets.

Arguably, stocks have shown to offer the most potential for growth as compared to many other asset classes. They are also far more liquid and diversifiable than real estate and many other fixed-income assets.

As a Nigerian, investing in the US as a non-resident was a difficult process prior to now. Most international brokerages would require, at minimum, a valid US visa or a green card in order to be able to invest in the US stock market. Investing in foreign markets was also relatively limited to high net worth individuals (HNIs) as the amount required to invest was, typically, in the thousands of dollars range.

One of the most common questions in investment groups and forums is “How do I buy shares of Apple, Tesla, Dropbox, Uber or Facebook?”

The NYSE and NASDAQ being the most valuable stock markets in the world have consistently outperformed every other market. Unfortunately, they have been largely inaccessible to Nigerians and Africans in general… until now.

This article will serve as a guide to get you started in investing in the US Stock Market.

What you will need:

⁃ Your Bank Verification Number (BVN)

⁃ Your Valid international passport

⁃ A recent Utility Bill or Bank Statement

How to get started

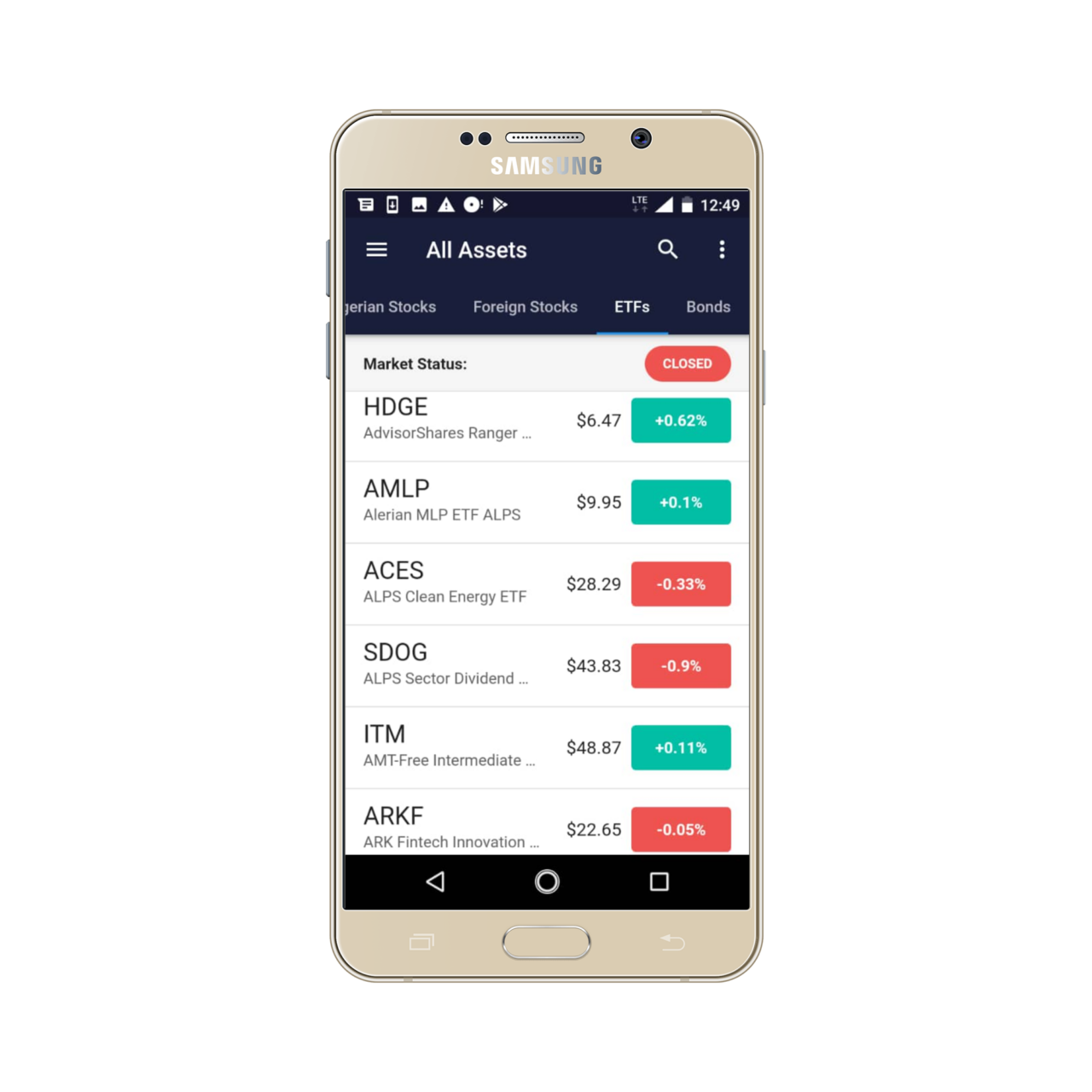

Download the Trove Android or iOS App from the Playstore or Appstore, respectively.

Curious about what Trove is?

Trove is a digital investing platform that lets you invest in stocks, bonds, exchange-traded funds (ETFs) and other securities directly from your smartphone.

How secure is Trove?

Trove ensures your personal information is secure by its use of 256-bit encryption & that your personal data is stored using cutting edge technology.

Trove’s partner, DriveWealth LLC, a self-clearing broker in the US is a regulated member of FINRA/SIPC and holds all the US trading accounts on Trove. It also protects securities holdings of its members of up to $500,000 (including $250,000 for claims for cash).

Trove’s other partner, Sigma Securities Limited, a broker-dealer regulated by the NSE (Nigerian Stock Exchange) & Securities and Exchange Commission, holds all Nigerian trading accounts.

Product Features of Trove:

Platforms: Android & iOS

Minimum Account Opening Balance: $10

Required Documentation: International Passport and a Utility Bill or Bank Statement. The documents will be an image, not an actual physical copy. Some basic information like (Verified Email Address, Verified Phone Number, Bank Account Information).

Payment Options: Mastercard, VISA, and Verve cards issued by Nigerian Banks. You can also fund your wallet via a Bank Transfer.

Holding period: As long as you like.

Security: Bank-Grade Encryption

Investment monitoring: You can track returns on investments purchased through the Trove app.

Withdrawals: You can withdraw uninvested cash in your wallet. You would, however, have to wait for 3 business days in the case of Dollar-denominated withdrawals. If you’re withdrawing more than your invested cash, you’ll need to sell some of your purchased assets. Sell orders take to get executed in real-time. You can either choose to deposit the funds into your wallet or bank account.

Why you should invest with Trove?

1. Low Minimums: Compared to other investment platforms that have high minimums, Trove allows you to buy stocks of US companies with as little as $10.

2. Fractional Shares: Trove lets you buy fractional shares in companies like Apple, Google, Facebook, etc. With fractional shares, rather than buy a full share which can cost hundreds of dollars, you can buy a fraction of a share.

About Trove Technologies Limited:

Trove Technologies Limited built and wholly owns Trove, a technology platform that allows Africans to invest in financial securities locally, within the continent, and internationally, outside the African continent. Trove also provides APIs and tools to broker-dealers and fund managers in order to provide access to global markets. Trove neither offers its own recommendations on any security nor provides its own research to any user per any security transaction and/or order. Trove is a technology platform, not a registered broker-dealer or investment advisor.

For more information, please visit here

You can also follow Trove on Twitter @trovefinance, Instagram @trovefinance and on Medium @trovefinance