A little over a year ago, in March 2018, FairMoney, an online lending platform, launched in Nigeria. Now, disbursing over one thousand five hundred loans daily, the company has helped thousands of individuals and small businesses get closer to their dreams and most importantly access to critical finance made possible by the power of technology.

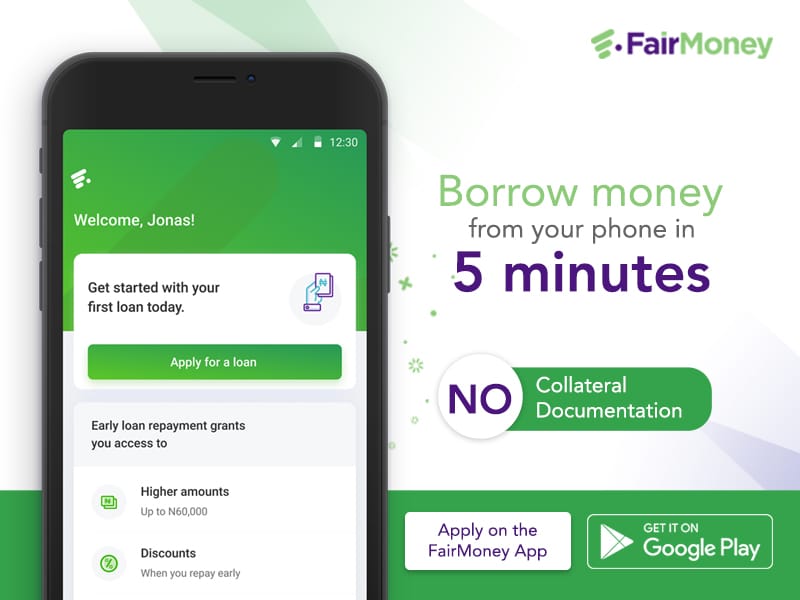

Customers access instant loans on FairMoney without collateral, extensive documentation or office visits which typically make borrowing money stressful for users.

FairMoney is taking customer experience to the next level and has launched an upgraded Android app to reflect this as it enters the next phase of growth. The new FairMoney app is easier to use and reflects the new brand which portrays the vision of providing access to financial services for everyone in Nigeria.

According to FairMoney’s Head of Growth and Marketing, Joy Uzuegbu, the short-term loan provider has optimized its algorithms and improved overall customer experience.

How to get a Loan on FairMoney

Getting a loan on FairMoney is easy and straightforward as described in a few steps below:

Download the Android app from the Google Play Store

Sign up or log in with your phone number or Facebook profile

Create your profile (for new users) and/or submit an application.

Receive money in your bank account within minutes.

In addition, customers can access higher amounts of up to N150,000 and 3 - month Installment loans. Customers with positive loan history performance would also be able to enjoy flexible interest rates.

While the Nigerian society has a sort of love-hate relationship with borrowing, the use cases for a product like FairMoney are extensive. From personal needs like paying bills, shopping and family dependencies to business loans for starting that side hustle or building a credit profile, FairMoney’s loan product covers a wide range of options.

FairMoney’s proposition seems built around customer-focus, secure technology and speed - all of which makes sense for an online loan service that doesn’t rely on collateral to reduce lending risk. Its 4.3-star rating on the Google Play Store validates that proposition to a certain degree. If you’re interested in short-term, quick loans that don’t require collateral or office visits, FairMoney is a good place to start.