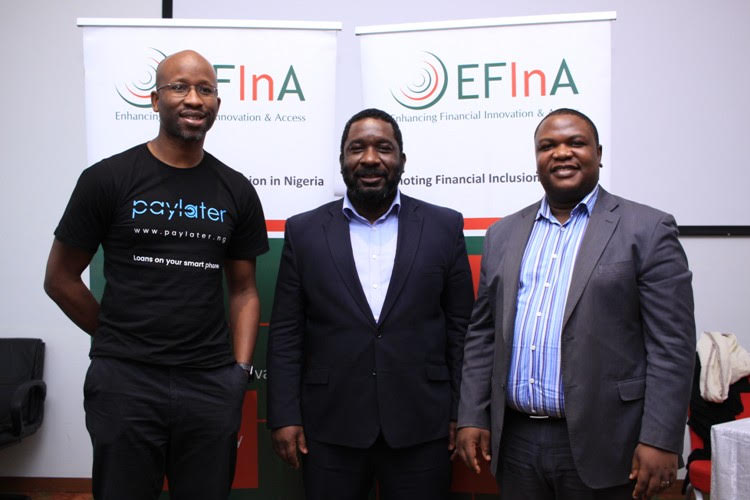

To further promote financial inclusion in Nigeria, Enhancing Financial Innovation and Access (EFInA) a financial development organization funded by DFID and Bill and Melinda Gates Foundation organized a FinTech Breakfast forum at Eko Hotel and suites on the 14th of June, 2018.

Through its Innovation Fund, EFInA targets the economically deprived population. Launched in 2009, the fund shares risks with Financial Service Providers (FSPs) by providing grant subsidies through the Technical Assistance Grant and the Innovation Grant to the amount of $250,000 and $2,000,000 respectively. The focus areas include agent networks, electronic payment, financial inclusive products and services especially across Northern Nigeria, women and financial literacy projects.

EFInA’s Board Chair, Mr Segun Akerele said that the

“essence of the forum is to request information from FinTechs on how EFInA can stimulate innovation targeted at the financially excluded through its grants, advocacy, research and capacity building”

He addressed over 40 different FinTech companies, regulators and digital financial service consultants that attended the forum. Mr Akerele also appealed to the forum to see the financially excluded as partners and an asset in our bid to boost economic growth and increase GDP.

Presenting on “Potentials For Driving Financial Inclusion Uptake through FinTechs”, Folasade Agbejule, EFInA’s Programme Specialists – Payments, stated that “According to the EFInA Access to financials survey of 2016 which covers about 23,000 respondents across Nigeria, 41.6% of adults are financially excluded even though they have access to mobile phones. Also, these adults do not have access to formal and informal financial services. The digital financial service system has a role to play in this situation to reach low-income earners and people in the rural areas.

Topsy Kola Oyeneyin, Associate Principal at Mckinsey and Company during her presentation on “Opportunities in Digital Financial Inclusion”, stated that

“thereis huge potential for digital involvement in Nigeria's financial services but thiscan only be attained if the three required building blocks are put in place. These building blocks are:widespread digital infrastructure, dynamic financial services market and the development of products people prefer to existing alternatives”.

The event involved a panel session where panelists including Segun Akerele, Tunde Kehinde; Co-Founder Lidya, Ngozi Dozie; Co-founder Paylater/OneFi, Jude Njugo; Beyond Credit CEO and NonnyMerenu; Unilever Sustainability Manager discussed issues relating to: the current state of financial inclusion in Nigeria, the FinTech landscape, the role of the Central Bank of Nigeria in driving financial inclusion in Nigeria as well as the barriers and challenges of the low income population to access financial services.

The panel, moderated by Tunji Elesho; CcHub Growth Capital fund and Suzanne Adeoye; EFInA Grants Manager identified the regulatory landscape, the availability of credible data as very important factors in the development of digital financial services.

The FinTechs that attended the forum generally agreed that there was a need for constant dialogue between all stakeholders so that the current obstacles to financial inclusion can be removed and the FinTechs can play an important role in the development of our economy and the promotion of financial inclusion in Nigeria. Some of the FinTechs that attended the forum include Flutterwave, Lidya, Paga, International Finance Corporation, Paylater, E-settlement, Sanwo, OyaPay, Spacpointe, Amplify, Afarapartners, Capricon Digi, Cassava and many others.

About EFInA

Enhancing Financial Innovation and Access (EFInA) is a financial sector development organization that promotes financial inclusion in Nigeria. Established in 2007, its vision is to be the leader in facilitating the emergence of an all-inclusive growth-promoting financial system. EFInA is funded by the UK Government’s Department for International Development (DFID) and the Bill & Melinda Gates Foundation.