For a high chance of success, it is important for startups and businesses in general to set measurable goals and objectives. These goals should be SMART (goals that are specific, measurable, achievable, realistic, and time bound) and assessed periodically with Key Performance Indicators (KPIs).

KPIs are metrics used to measure a company's progress in achieving its strategic and operational goals. As a startup owner it is important to know your numbers, because like they say “if you can't measure it, you can't improve it”. So if you're aiming to grow your startup especially if you are seeking funding from investors, the need for collecting and analyzing relevant business data can not be overemphasised.

Since different businesses have their own peculiar goals, the metrics for measuring these diverse goals will differ depending on a company’s priority and industry. So it is pertinent for companies to set the right goals and track relevant KPIs to achieve them.

However, regardless of your company’s unique goals, to ensure smooth business operations, these are some key KPIs that every startup should continuously trail;

Customer Acquisition Cost (CAC)

Typically your customers will come at a price. To acquire new customers you are likely spending money on marketing, sales and advertising. The CAC tells you the amount of money spent on acquiring a single customer and this can help you optimize your return on investment. Tracking your CAC reveals the efficiency of sales and marketing processes.

How to Calculate CAC

To know your CAC, simply calculate the total amount of money spent on reaching potential customers and divide by the actual number of customers acquired within a particular time.

Things to look out for

- A very high CAC may be an indication of a flaw in your sales and/or marketing process

- You can boost profits by devising ways to reduce your CAC

- Understanding your CAC can help you plan future capital allocations

- Investors can determine the profitability of your firm by comparing your CAC to the actual revenue generated from acquired customers

- Your CAC is expected to reduce with time as you build your brand.

Customer Retention Rate (CRR)

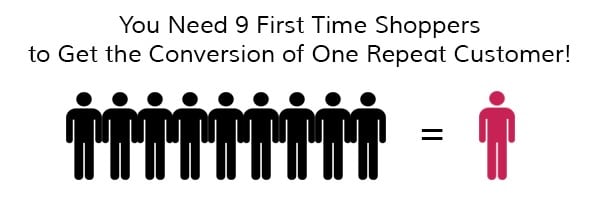

How long do your customers stay with the business? You don't want to spend resources acquiring customers only to have them leave after a short while. A good way to measure customer loyalty is by tracking your Customer Retention Rate (CRR).

Be the smartest in the room

Give it a try, you can unsubscribe anytime. Privacy Policy.

CRR tells you the number of customers that stick with your business within a given time period (monthly, yearly etc) without including the number of new customers acquired.

How to calculate your CRR

CRR = ((E- N)/S) x 100

Where E= Number of customers at the end of a period

N = number of new customers acquired during the period

S = Number of customers at the start of a period

For instance, if you have 100 customers at the start of a period and you lose 10 customers and gain 20. You have a total of 110 customers at the end of that period and your customer retention rate is;

((110 - 20)/ 100) x 100 = 90%

Why you should track your CRR

- CRR gives an indication of how good your customer service is. Happy customers are loyal customers, so monitoring your CRR can help you put processes in place that can boost customer satisfaction when required

- It is more expensive to acquire a new customer than to keep an old one, so you can increase profits by boosting your CRR

- Implementing good CRR strategies can boost your brand reputation

Revenue Growth Rate (RGR)

RGR measures the increase or decrease in the revenue or sales generated by a business within a specified time period. This gives a strong indication of how quickly a startup is growing and can also help owners make strategic decisions.

It is advised that this metric is measured over different time periods; it can be measured monthly, quarterly, yearly e.t.c. Calculating the RGR for a longer time period (e.g twelve months) gives you a more accurate picture of your growth.

How to calculate your RGR

To calculate your monthly revenue growth rate simply subtract the previous month’s revenue from the revenue of the current month, then divide this value by previous month’s revenue and multiply by 100

So if you recorded a revenue of ₦150,000 in your first month and ₦200, 000 in your second month, your RGR is;

200,000 - 150,000/150,000 x 100 = 33.3%

What to look out for

- Continuous increase in revenue growth rate should result in an increase in net profit

- Investors use trends in revenue growth rate to gauge a startup’s current and potential growth

- Revenue growth can be broken down to reflect growth for different product and services offered

Burn Rate

This is one of the important KPIs every startup should track. A company’s burn rate suggests how long it can operate before it runs out of cash and this gives entrepreneurs a clear idea of when they need to consider funding.

There are two types of burn rate;

Gross burn rate: This is the total amount of money a company spends in a month to keep the business running i.e all its operating costs.

Net burn rate: This is the total amount of money a company loses each month. The term “burn rate” typically means net burn rate.

How to calculate your burn rate

A business that spends ₦200,000 on operation costs and generates a revenue of ₦150,000 monthly has a gross burn of 200,000 and a net burn of ₦ 50,000 (200,000- 150,000).

Hence if this business has only half a million naira in the bank. It is expected that the business can only survive for about 10 months (500,000/50,000) without injection of funds

Investors typically look out for your burn rate and it is important for entrepreneurs to track this number to manage cash more efficiently.

Things to look out for

- A negative net burn rate is good, as it indicates that a business is building up cash reserves rather than depleting it

- When burn rate exceeds its forecast, measures have to put in place to boost revenue and reduce expenses

- A high burn rate may not always be a bad idea, depending on what money is spent on. However, it is generally safer to keep burn rate low

Gross Profit/ Gross Profit Margin

Gross profit or sales profit refer to the revenue left after deducting your cost of production (COG). Your COG includes all the direct expenses needed to create a product or service such as; the cost of raw material, electricity cost and cost of labour. Gross profit is expressed as a number that can be compared between different time periods.

The gross profit of a business indicates how effectively resources are utilized in the production process. It also highlights areas for improvements and helps businesses make vital decisions.

How to calculate gross profit

Gross Profit = Revenue (sales) – Cost of goods sold

Gross profit margin, on the other hand, refers to gross profit as a percentage of the total revenue. While gross profit gives you an absolute profit value, gross profit margin gives a direct comparison between profits and revenue generated

Gross profit margin = (Gross profits/ Revenue) x 100

The gross profit margin reveals the proportion of profits generated by the sale of products or services, before accounting for sales and administrative expenses. You can calculate your gross profit margin easily with this SME toolkit.

However gross profit margin doesn’t show the overall profitability of a business since it doesn’t include operating expenses or overhead cost. To measure this, you will need to track your net profit margin

Things to look out for

- Your gross profit margin reveals how you stand against competitors by comparing it against the industry benchmark

- A low gross profit margin suggest that production costs are too high and should be reduced or sales price increased

- A gross profit that is not sufficiently large indicates that a business cannot pay for its operating expenses